In November, China’s EV market was largely booming, with the exceptions of Li Auto and Nio. Xpeng grew by about 30%, Geely by 13%, Xiaomi by 6% and BYD was almost flat, up 0.7% compared to October.

– Advertisement –

All delivery data comes from company registrations, which are reported on the first of each month. Xiaomi is the exception in that it only offers vague numbers such as “20,000+” units; For example, China EV DataTracker provides estimated delivery numbers. The sales figures are wholesale figures, so include exports, if any.

All data shows sales of new energy vehicles (NEVs). NEV is a Chinese government term for BEV (battery electric vehicle), PHEV (plug-in electric vehicle) and FCEV (fuel cell electric vehicle). FCEV (hydrogen) sales are virtually non-existent in China.

– Advertisement –

Leadership for Sales

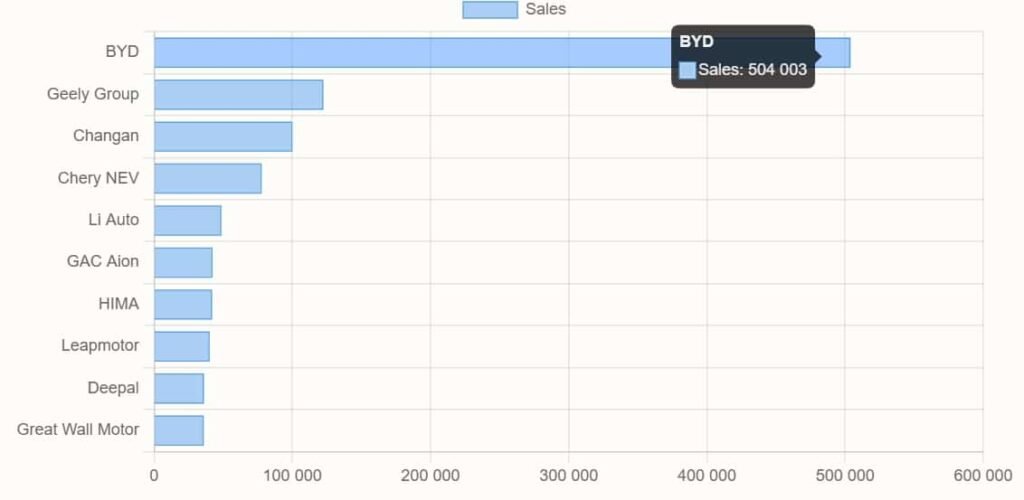

BYD sold 504,003 passenger NEVs, up 0.7% from 500,526 units the month before and up 67.2% from 301,378 in the previous year.

In 2024 (January-November), the company sold 3,740,930 passenger NEVs, an increase of 40% compared to the same period last year. BYD’s official sales target for 2024 is 3.6 million. CarNewsChina expects BYD to deliver 4.35 million vehicles in 2024.

BYD sold 198,065 passenger BEVs in November, up 4.5% from the previous month. PHEV sales fell 1.6% to 305,938 units.

– Advertisement –

In 2024, the gap between BEV and PHEV sales widened. In December 2023, BEVs accounted for 56.1% of BYD sales, while in October 2024 this was only 37.9% and PHEV sales increased to 60.7%.

In November, BEV’s share of BYD sales rose slightly to 39.3%, while PHEV sales fell to 60.7% as the gap stopped widening.

BYD will stop selling only ICE vehicles in 2022.

BYD’s sales data includes all its brands: Denza, Fang Cheng Bao and Yangwang.

Yangwang, BYD’s most premium brand, delivered only 302 vehicles in November, continuing its sales decline from March. The Yangwang U8 off-road EREV SUV sold 278 units, while the U9 all-electric supercar sold 24 units.

Fang Cheng Bao, positioned directly below Yangwang, sold 8,521 vehicles in November, up 41.4% from 6,026 in October.

Denza, the former joint venture between Mercedes-Benz and BYD, sold 10,002 vehicles in November, up 7.2% from October and down 15.6% from last year.

Includes Denza, Yangwang and Fang Cheng Bao

Geely Auto took second place with 122,453 NEVs sold, up 12.6% from 108,722 in October and 88.3% from 65,034 units the year before. In 2024 (January – November), Geely Auto delivered 777,029 NEVs, an increase of 82% compared to the same period last year.

Geely Auto NEV’s sales include the main brand and series Zeekr, Lynk&Co, and Geely and Geely Galaxy.

Zeekr posted record deliveries of 27,011 units, up 7.8% from 25,049 in October and 106.1% from 13,104 units the year before. In 2024 (January – November), Zeekr delivered 194,933 electric vehicles, an increase of 85.5% compared to the same period last year.

Includes sales of Zeekr, Lynk&Co and Geely and Geely Galaxy NEV.

Changan took third place with 100,000 NEV sales, up 17.6% from 85,000 units in October. The data posted by Changan is most likely rounded, despite this being explicitly stated by the company.

Changan’s sales include the Avatr, Deepa and Qiyuan brands.

Avatr sold 11,579 electric vehicles, up 15% from 10,056 in October.

Deepal achieved record sales of 36,026 units in November 2024, up 29.3% from 27,862 units in October and up 123.0% from 16,157 units in the same month last year.

Li Auto reported deliveries of 48,740 units in November 2024, down 5.3% from 51,443 in October, but up 18.8% from 41,030 units in the same month last year.

In 2024 (January – November), Li Auto delivered 441,995 EVs, an increase of 35.7% over the same period last year.

GAC Aion sold 42,301 units in November 2024, up 5.6% from 40,052 in October and up 1.8% from 41,567 units in the same month last year.

HIMA reported sales of 41,931 units in November 2024, up slightly 0.7% from 41,643 in October.

HIMA is Huawei’s EV alliance, including the Aito, Luxeed, Stelato and Maextro brands.

Stellantis-backed Leapmotor achieved record sales of 40,169 NEVs in November 2024, up 5.2% from 38,177 units in October and up 117.0% from 18,508 units in the same month last year.

Great Wall Motor reported NEV sales of 35,999 units in November 2024, up 12.4% from 32,039 units in October and 15.2% from 31,248 units a year earlier.

Great Wall Motor sales include the Haval, Wey, Tank and Ora brands.

Volkswagen-backed Xpeng reported sales of 30,895 units in November 2024, up 29.2% from 23,917 units in October and 54.2% from 20,041 units a year earlier.

In 2024 (January – November), Xpeng delivered 153,373 electric vehicles, an increase of 26.2% compared to the same period last year.

Xpeng’s sales include the Mona series, which Xpeng said shipped more than 10,000 units in November. Mona currently sells just one car, a Tesla Model 3 competitor, the Mona M03 sedan, which was launched in August.

Xiaomi recorded sales of over 20,000 units of its sole model, SU7. According to China EV DataTracker, November deliveries reached 21,955 units, translating to a growth of 6.1% from October’s 20,700 units.

Xiaomi started deliveries of the Xiaomi SU7 sedan in March. The second car, an electric SUV, will be unveiled in early 2025.

Xiaomi’s cumulative sales reached 112,516 electric vehicles in November, according to data monitored by China EV DataTracker.

Nio reported global EV sales of 20,575 units in November 2024, down slightly 1.9% from 20,976 units in October, but up 28.9% from 15,959 units last year.

In 2024 (January – November), Nio delivered 190,832 electric vehicles, an increase of 34.4% compared to the same period last year. Nio’s turnover includes sales of the entry-level brand Onvo.

The Nio brand delivered 15,493 electric vehicles in November, down 2.9% from 15,959 units last year and 7% less than in October. Onvo delivered 5,082 electric vehicles, an increase of 17.7% compared to the 4,319 units in October.

Last week, Onvo president Alan Ai confirmed that the December delivery target would be more than 10,000 units. To achieve this goal, Onvo would need to grow its revenue by almost 100% month-over-month.

Onvo’s only model is the L60 SUV, which was launched in China in September as a rival to Tesla Model Y. It starts at 206,900 yuan (28,580 USD) for a 60 kWh version equipped with a BYD blade battery, Nvidia Drive Orin- chip and 240 kW rear motor (322 hp). The dimensions are (L/W/H) 4828/1930/1616 mm and the wheelbase is 2950 mm.

Including Onvo

SAIC-VW, Volkswagen’s Chinese joint venture with Shanghai Auto, sold 14,360 NEVs under the ID. series in November, largely flat from 14,286 units in October.

Baidu-Geely venture Jiyue sold 2,485 electric vehicles, down 20% from 3,107 in October.